Initial Public Offering (IPO) has lost its sheen on the Dalal Street

since a long time now. Invariably, the sentiment in the IPO market is

directly proportional to the optimism-count in the secondary market.

Now that the market sentiment has improved since more than a month,

led by brightening macroeconomic fundamentals of the economy; it’s high

time that the primary market lights up its courtyard with a bandwagon of

high-profile fund raising sprees.

On this note, what better than the MCX IPO, India’s largest commodity

exchange by turnover, to mark the turn of events in the ailing primary

market – it can easily be termed as mother of all the IPOs in the recent

times.

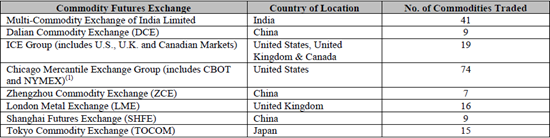

The multi-commodity bourse MCX, which is also the 5th largest exchange in the world,

is all set to hit the capital markets to raise up to Rs.663 crore.

Investors can subscribe to the MCX IPO at a price band of Rs.860 to

Rs.1032 per share starting from 22nd Feb to 24th Feb, 2012.

The Multi Commodity Exchange (MCX) allows trading in over 40

commodities across sectors and accounts for almost 87% of the market

share of the Indian commodity futures exchange industry. Interestingly,

MCX is also the largest silver exchange in the world and 2nd largest gold, copper and natural gas exchange globally.

[MCX DRHP]

The listing will take MCX on par with other global exchanges such as

NASDAQ, NYSE Euronext, CME Group and SGX. Moreover, the credit rating

agency CRISIL has assigned the top-most rating of 5/5 for the MCX IPO indicating ‘strong fundamentals’ of this Indian exchange.

In its grading rationale, CRISIL has reaffirmed MCX’s leadership

position in the Indian commodity futures market over the last four

years, with a share of over 82% of the overall traded turnover in FY11,

led by volumes in bullion, crude oil, copper and natural gas. ‘

The rating agency has also credited the company with a strong

technology-backed trading platform, and infrastructure supported by its

promoter Financial Technologies, apart from the exchange’s ability to

provide high liquidity and low impact cost of transactions.

MCX IPO Details

- Issue Period: Feb 22 to Feb 24

- Issue Size: Public offer of 6,427,378 equity shares of Rs.10 each

- Issue Type: 100% Book building

- Price Range: Rs.860 to Rs.1032/-

- Face Value: Rs.10/-

- Market Lot: 6 equity shares

- IPO Grading: 5/5 (CRISIL)

Over the last 3 years, MCX has benefited from volume explosion in

bullion trades, especially, gold and silver. While gold volumes have

remained constant over the last year, the silver volumes have been the

top driver in commodity-wise contribution based on traded value for MCX

since FY11. In order to further spur its volumes from bullion trades,

recently, MCX has introduced Gold Mini and Silver Micro contracts, which

are aimed at local and retail investors.

VALUATIONS: At the upper price band of Rs.1032, the

issue is reasonably priced at 18 times, based on annualized FY12

earnings – which are lower in terms of valuations as compared to other

exchanges and relatively slower growth rates. Investors can subscribe

the IPO from both listing gains and long-term investment perspective.

Grey Market Premium for MCX IPO: Rs.300-350 per share

No comments:

Post a Comment