In the United States, it is customary to sign-up for credit cards online and even get the approval instantaneously. They have a very structured way of assessing Individuals’ creditworthiness as everything is tied back to their Social Security number.

It is very easy to assess one’s creditworthiness and eligibility because in USA they have full access to the historical financial transactions done by the assessee. FICO score, a point based system lets the lenders know about Individuals creditworthiness.

In India however, for lack of such a centralized system – it was difficult for lenders to have a standardized way of assessment. However, thanks to CIBIL, the credit rating agency, Lenders and Bankers now have a way to know about Individuals past financial activities.

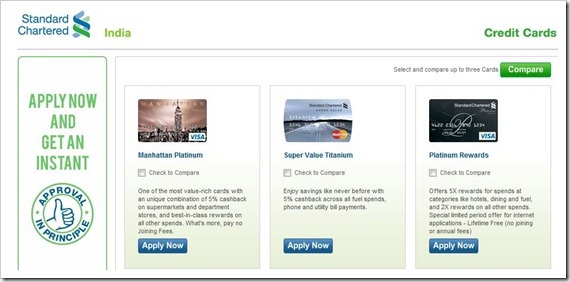

Standard Chartered Bank has become the first Bank in India to start offering instant online Credit Card approval process. The applicants has to just visit their site, fill in their personal & demographic details. The online application process involves verification of key customer details such as the Permanent Account Number, mobile number, email ID and credit history through CIBIL, and other internal eligibility criteria.

Once applicant submits the application, immediately he / she will be shown whether they have been approved (AIP) or not.

If the application is approved, the applicant is contacted by the bank for collection of documents. The final approval process involves completion of ‘Know Your Customer’ and credit approval processes.

The application also be tracked online by going to their application status page.

I am sure other banks and credit card companies will start following similar methods, which cut down the approval times from days to minutes and with great convenience to applicant as well the Bank.

If you are interested in picking up a credit card, do give it it try and let us know what you feel. However, before you do that, make sure you read this article on how to effectively manage your Credit card debt.

I had no idea my credit was bad. The guys at Credit Sudhaar analysed my report. The process took some time but my credit was restored, enhanced and protected. I have no reason for complaints.

ReplyDeleteIt is a stunning post.your blog is giving very useful knowledge for all. Exceptionally valuable to me. I preferred it. And i'm sharing your information to all friends.For more details about me,log on to

ReplyDeletecash against credit card in chennai at low interest